Many millennials do not invest, which can hinder their ability to achieve important goals, like purchasing a home or retiring comfortably. Beyond income constraints, what barriers, perceived or real, prevent millennials from owning investment accounts? Do millennials’ views on investing differ from Gen Xers and baby boomers? Within the millennial generation, are there significant demographic differences in investing behaviors and attitudes? How do millennials view the financial services industry and financial professionals? And what do millennials think about emerging financial technologies, like robo-advisors?

These and other questions are addressed in a 2018 research study published by the FINRA Foundation and CFA Institute:

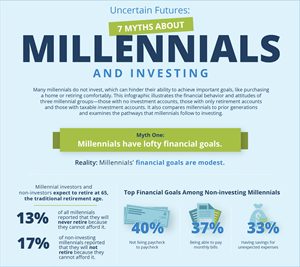

- Issue Brief: Uncertain Futures, 7 Myths about Millennials and Investing

- Full Report: Uncertain Futures, 7 Myths about Millennials and Investing

- Download the study data files and survey (Stata and Excel formats)

Please review the data set Terms of Use. - Watch to learn more about the study findings:

For questions about the study, please contact the FINRA Foundation’s research director, Dr. Gary R. Mottola (202) 728-8351.

This study was conducted in collaboration with Zeldis Research Associates.